The cheapest mortgage rates can be found online, but the optimum time to secure the best home loan rates are on the first day from the calendar month. By looking around on the first day from the 30 days, you may secure a low monthly interest for the lifetime of the loan. The normal federal mortgage rate is 3.46Percent. This is based on the lending options available from 200 top creditors. The borrowers need to have a FICO credit history between 700 and 760 along with a financial loan-to-value best 10 year mortgage rate canada percentage of 80Per cent.

If you are re-financing your existing bank loan or purchasing a fresh one, you will want to look for the best 10 season house loan amount Canadapossible. Unfortunately, this isn’t as basic as it appears. Home mortgage interest rates may vary widely between loan companies and home loan plans, plus they go up and down day-to-day since the financial markets change. Although looking at mortgages, don’t neglect to aspect in shutting costs, things, and the size of the loan.

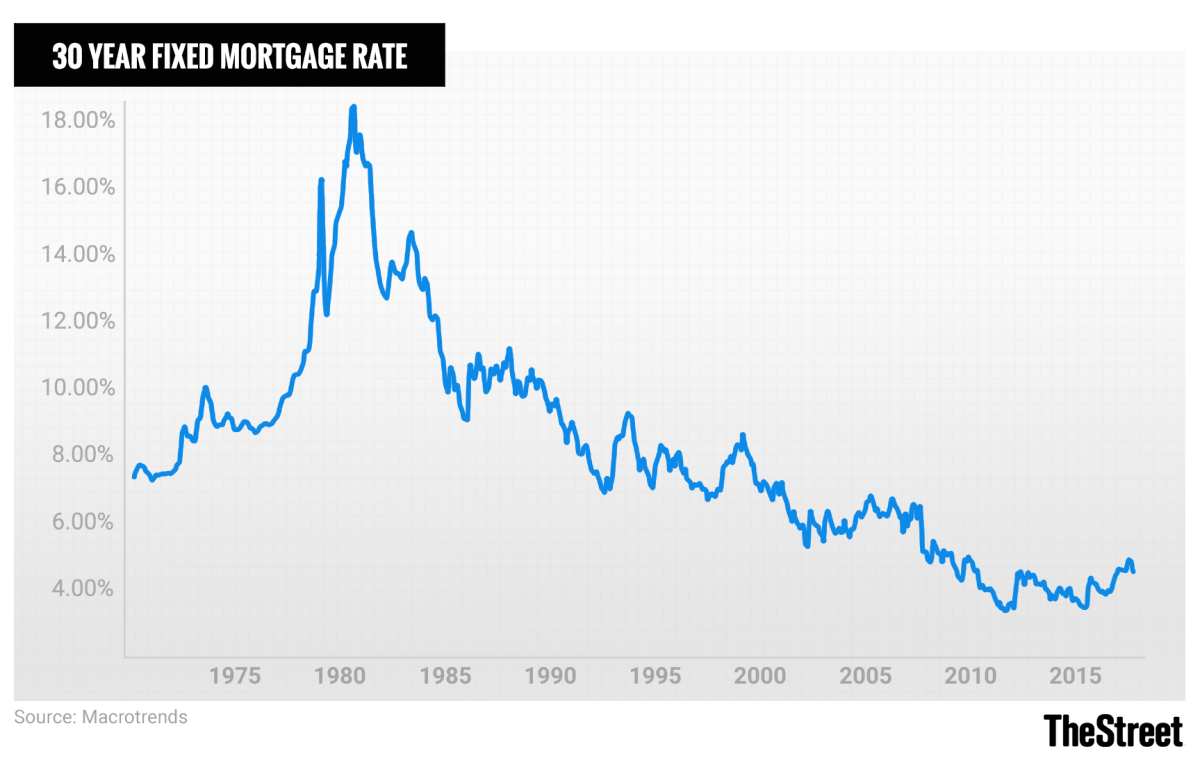

Even though home loan rates have started to increase, they are still near historic lows. A number of pros believe that the standard interest for 30-12 months resolved-level personal loans will not go over 4Per cent at the end of the season. Consequently, a great idea is always to wait until you’ve enhanced your credit history before you apply for a home loan. If you can’t wait around, consider the fiscal benefits associated with trying to get a new loan when your credit history increases.

Home loan rates are subject to a variety of elements, for example the all around health of the overall economy. The Federal Arrange units standard interest levels, however, many other variables are involved. Such as your credit ranking, financial loan-to-value ratio, as well as your financial debt-to-earnings proportion. The lowest house loan level depends on your own personal fiscal situations. In case you have an increased credit standing and very low debts-to-income percentage, it will be simpler to qualify for a reduced monthly interest.

As home loan rates begin to climb, the optimum time to freeze a minimal interest rate is already. By sealing inside a lower level, you can rest assured that the obligations will continue to be cost-effective. But take into account that interest levels usually are not resolved and may even improve or lessen anytime.